Tasty meals for under a pound – the MoneyAware cheap meals challenge

This month we’ve challenged ourselves to cook the tastiest meal for under...

With 10% of our clients stating separation or divorce as the reason for getting into debt, it’s the fifth most common cause of financial problems that we see.

This is the situation Rosie* from Leicestershire found herself in when she separated from her partner.

Already struggling to meet payments to credit cards, she had to rent a property for herself and her daughter to live in. Rosie found it difficult to pay the letting agent’s fees and furnish the home, and soon found her financial situation spiralling further out of control.

“I was running out of money, so was relying on credit cards to go spending. Before you know it you’re filling up the car with petrol and doing the food shopping all on credit card”, Rosie said.

Rosie kept up with the minimum repayments on her credit cards, but this left her with no money to cover living costs.

Family and friends helped Rosie out with unexpected expenses, such as when she needed to buy a new battery for her car, but she also turned to other forms of credit to cover everyday essentials. Like two-thirds (68%) of clients who have credit card debt, Rosie also has a personal loan, as well as debt on a store card.

When she got in touch with us we looked into how we could best help Rosie, and she’s now on a debt management plan (DMP) with us. For her, a DMP ensured that her money went towards paying her essential bills first, before covering payments to her unsecured debts, helping her to break the never-ending cycle of credit.

Relying on credit cards to pay for essentials is a sign that you might need debt advice. If you’ve paid more in interest and charges than you have towards your credit card’s balance over the past 18 months, your card is in ‘persistent debt‘.

By paying more each month, you could reduce your credit card balance quicker and move your account out of persistent debt. You could also save yourself money because you’ll pay less in interest.

If you’re not sure if you’re in control of your credit card, store card or catalogue repayments, try our 60-second repayment checker to get a clearer picture.

Answer 5 quick questions to find out.

It shouldn’t take more than a minute to get a clear picture of whether you’re on top of your credit card, store card and catalogue repayments or not.

1

Did you pay only the minimum payment last month?

2

Do you regularly pay only the minimum payment?

3

Have you had any letters warning you that you’re in ‘persistent debt’?

4

Do you ever miss payments to your credit card, store card or catalogue accounts?

5

Do you worry about not being able to keep up with repayments or not being in control of your credit?

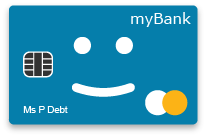

You’re in control

Based on your answers it sounds like you’re in control of your repayments.

Because you’re not missing any payments and you’re not just paying the minimum each month, you’re reducing your balance. You’re also saving money by not paying interest.

Make the most of your money with income-boosting, money-saving and budgeting-busting tips, direct to your inbox.

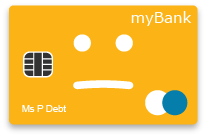

Sign up to MoneyAware emailsThings are OK

Based on your answers, it sounds as though you’re mostly keeping on top of your repayments at the moment.

That’s great. By paying more than the minimum payment each month, you reduce your credit card balance quicker and you can also save yourself money because you’ll pay less in interest.

Find out more about what can happen if you’re only making minimum payments by clicking the button below.

Find out moreYou could make some improvements

Based on your answers it looks as though you’re doing everything you can to keep on top of your repayments, but you might be able to make improvements.

If you depend on making the minimum payment each month, you’re at risk of your account being in ‘persistent debt’. Your creditors will contact you and ask you to pay more each month.

Find out moreOr you can contact our dedicated persistent debt team on 0300 303 2517. We’re available Monday to Friday 9am to 5pm.

And if you’ve missed any payments, you might be struggling to keep on top of your finances. Find out how we can help you.

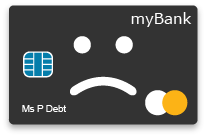

You need debt help

Based on your answers, it looks like you’re struggling financially. We can help you out. We’d recommend you get in touch with us for free debt advice.

Use our online debt advice tool for tailored budgeting advice and a personal action plan.

Get debt help nowIf you’d like to talk to a debt advisor, please call us on 0800 138 1111. We’re open Mon-Fri, 8am-8pm, Sat 8am-4pm.

John, Greater Manchester

StepChange don’t judge you. They’re here to help. I feel a lot less stressed thanks to them.

Richard, East Anglia

Words can hardly describe how great a service StepChange do, I feel like my life has improved so much thanks to the help they provide.

Jessica, Gwent

They’ve helped me so much! Can’t thank them enough.

Brendan, Stirlingshire

A big thank you to StepChange for not judging me and for all your assistance and support.

Beth, Devon

The service has been amazing, I feel a massive weight off my mind and no longer worry about my finances.

If you know someone who’s struggling with money, let them know that we’re here to help. Point them in the direction of our 7 Days, 7 Ways email programme, and we’ll send them an email each day for a week, helping them take steps to take control of their debts.

For more information about personal debt in the UK, download our Statistics Yearbook 2018.

*Names have been changed

Save

Save

Save

Posted by StepChange MoneyAware in Living with debt

31 Mar 2015

This month we’ve challenged ourselves to cook the tastiest meal for under...

We’ve put together a simple infographic which lists the basic dos and...

Find out how you can cut the cost of your next water...