We ask Facebook…what are your life changing money resolutions for 2013?

It’s that time of year when we all start thinking about making...

If over 25 years of helping the UK deal with debt has taught us anything, it’s this: debt problems don’t just happen overnight. They slowly build up over time and can affect anyone, no matter what their circumstances.

Many people have a potential debt problem without even realising it.

Minimum payments are meant to give you flexibility if you need it. If it’s a tight month, money-wise, no big deal! Just pay the minimum on your credit card, catalogue or store card and your credit rating won’t be affected.

Great, right? Not quite.

See, minimum payments mainly cover any interest or charges you’re incurring. Only a small portion of the payment goes on the balance itself, if at all. This means that for months, years, maybe even decades, the actual amount of money you owe isn’t going down.

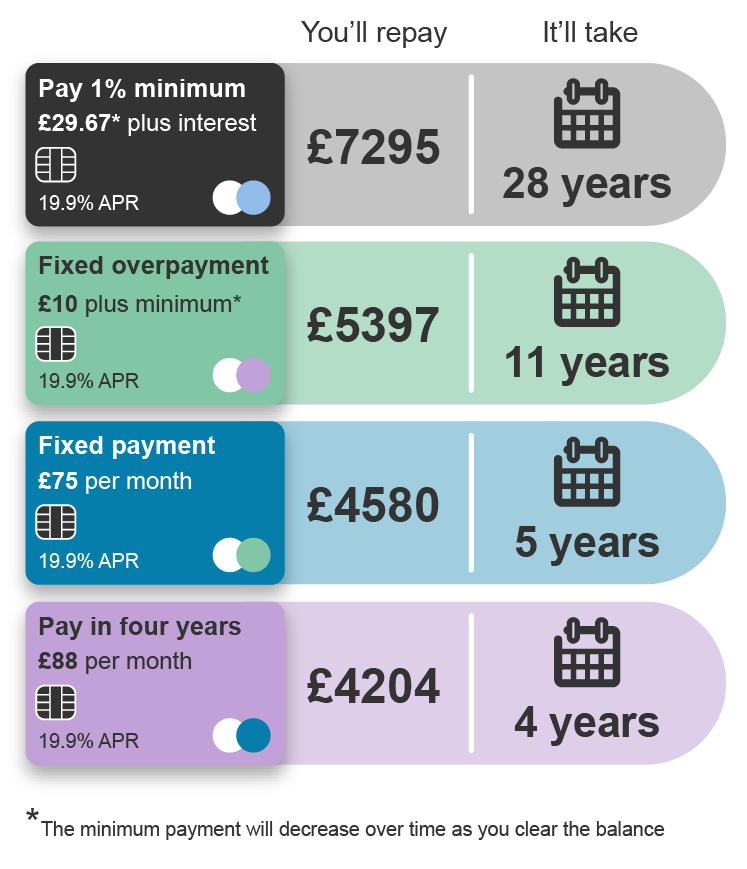

As you can see from this chart, minimum payments are practically useless when it comes to paying off your debt, and can keep you in debt for a long, long time.

Are you in control of your repayments? Click here for our 60-second checker.

If you subscribe to our MoneyAware newsletter, you may have seen our article explaining why your minimum credit card payment’s gone up. If your minimum payment has increased, it’s because your creditor is trying to prevent a ‘persistent debt’.

This is based on rules set out last year by the Financial Conduct Authority (FCA).

From this month onwards, catalogues and store cards will also come under the same rules. That means if you’ve been paying the minimum on any of these products each and every month, your creditor may eventually:

Our ‘Get Active about Minimum Payments’ campaign starts on Monday. During the campaign, we’ll:

We’ll also be sharing our top money-saving tips and hosting live Facebook Q&As to help you take control of minimum payments once and for all!

The campaign starts next week, but in the meantime, get to know more about persistent debt and what you can do to get your credit balances under control.