Targeted by payday loan spam texts?

This week is National Student Money Week, organised by the National Association...

People feel that they’re not being treated fairly by some of the companies they owe money to and borrow money from. That’s the message we received from our clients in our recent research into creditor and debt collector conduct.

Our research reveals the kinds of organisations that are most likely to make people feel unfairly treated, and the kind of unfair treatment they’re receiving. We’re campaigning for changes to be made in those organisations to help those in debt and to reduce unfair treatment.

Have you experienced similar issues to what we’ve found? Add a comment at the end of the article.

Our research suggests a large proportion of our clients have their debt problems made worse by unhelpful practices from the organisations they owe money to, making a bad situation worse.

Visit our Credit and Debt Collector conduct report page to see the full table.

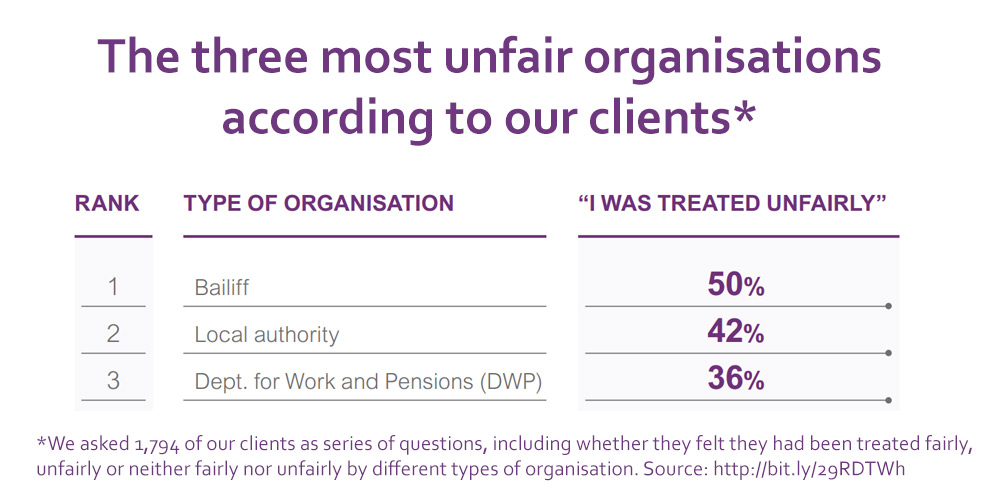

The findings reveal that our clients feel most unfairly treated by bailiffs (50% of clients contacted by them felt they weren’t fair), local authorities (42%) and the Department for Work and Pensions (36%). Organisations such as high-street banks (21%) and credit card companies (20%) are further down the list, and while still having unacceptably high numbers, there notably fewer clients feeling unfairly treated.

These results show some that our clients are more likely to feel unfairly treated by bailiffs and public sector creditors than regulated financial services creditors, like banks. We think this could show that robust regulation of financial services is linked to fairer treatment.

Our research also showed some areas of creditor and debt collector behaviour that are a cause for concern, such as unrequested credit card limit increases, the treatment of vulnerable people, and treatment of those in debt.

We found that unrequested credit limit increases made debt problems worse for 30% of those receiving them. Currently, credit card companies must provide the ability to opt-out of such increases, but we believe this research shows the need to change to an opt-in system.

When asking clients about any vulnerabilities – beyond their financial vulnerabilities – the report finds that 83% of clients said at least one of their creditors didn’t take their vulnerability into account after the client made them aware of the issues.

Our research suggests that poor debt collection behaviour is a problem for many of our clients. Out of the 1,794 people we surveyed:

This shows that bad behaviour from creditors and debt collectors is widespread. This is bad news because we know that this makes it even harder to repay debts. So better treatment of those in debt would help everyone, including creditors, as people would find it easier to repay.

Make a complaint.

It can be tempting to ignore it because you don’t want to cause a fuss. However, it’s important to let companies know when you’re unhappy with the service you’ve received. It’ll give them a chance to put things right but it also means they can address the root cause and other people will receive better treatment too.

Our website has useful advice on how to complain about a creditor, including some great tips on the right way to go about making a complaint, such as noting down the time of all your phone calls and the names of people you speak to, so you can refer back to them later.

It can sometimes be hard to know if you’ve been badly treated by a creditor. It’s reasonable for them to contact you about a debt from time to time, but they have to act within the rules and treat you fairly. If you’re not sure if they’ve overstepped the mark, we’ve got some examples of creditor harassment which may help.

Our research into creditor and debt collector conduct shows that there are some problems that need to be addressed. We’re calling for changes to help to improve the way people in debt are treated, including:

Read our full report to get all the details about our research into creditor and debt collector conduct, and let us know your thoughts in the comments below.

Responses