You’ve been making payments on your credit card, store card or catalogue each month. However, you’ve just got a letter from your provider saying they’re going to increase your monthly repayment, or suggested you do so. Why?

If you’ve been paying more in interest and charges than the balance for 18 months or longer, this is classed as ‘persistent debt’.

Your minimum monthly payment on these products includes:

- an amount for interest and charges

- an amount to reduce what you owe

A persistent debt takes a long time to reduce because all that’s being paid off is the interest, or at most a very small part of the balance. Increasing your monthly payment means you’ll pay more off what you owe, and this’ll help you clear the balance quicker.

As well as on this page, you can visit our persistent debt hub to find out about persistent debt, and work out how paying a little more each month can make a big difference.

How much of my monthly payment covers my actual balance?

The monthly payment you make towards your credit card, store card or catalogue account includes

- An amount for interest and charges

- An amount to pay off the money you actually owe

When you only pay the minimum each month, the debt takes a long time to reduce because your payment mainly goes towards your interest. Only a small portion of the payment goes towards the balance.

If you repay more each month, more of your money will go towards your balance and you’ll pay off your debt quicker.

Try the repayment calculator now to find out how much quicker you could pay off your debt by making increased payments.

To find ways to pay your debt off quicker, read our persistent debt guide (PDF).

How can I get my card or catalogue account out of persistent debt?

To help to repay more of your persistent debt balance, you could try one or more of the following options:

Get in touch with your credit card, store card or catalogue account provider

They may choose to suspend interest and charges on your card for a period of time. If you’re considering moving your persistent debt to a loan or card to another bank, let your current provider know. They may be able to offer you a better deal.

Don’t spend any further money on the account

By doing this, you’ll see your balance reduce quicker. Use our repayment calculator to work out how much more you could pay each month to clear your debt quicker [please note: the calculator isn’t optimised for mobile phones, so you may have an easier time using it on a desktop PC].

Look at ways you could pay this debt off quicker

This can range from putting your persistent debt balance to a cheaper credit card, or taking a look at your budget to see how much extra you could pay towards your debt each month.

Our persistent debt hub has more practical tips on how to pay your credit card off quicker.

How long will it take to pay my debt off?

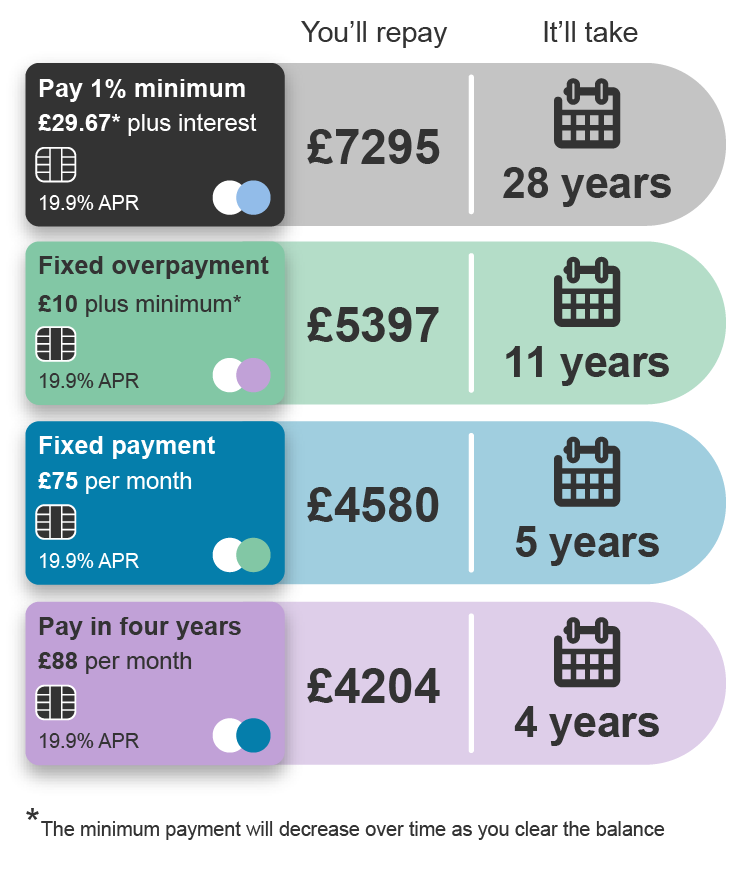

Let’s say that you owe £2967 on a credit card. The graphic below tells you how long it could take you to pay off this balance by only paying the minimum.

Depending on how much you can increase your monthly payment by, there’ll be a drastic reduction on the total amount you pay off over time.

By repaying more each month, you could dramatically reduce your credit card balance and save money and time. How much you need to pay depends on your interest rate. You also need to understand how much you can afford before committing to an increased amount each month.

(please note: these figures are based on estimates and can vary depending on your interest rate).

What if I don’t increase my payments?

You can carry on making the minimum payments towards your credit card, store card or catalogue account if you wish. Doing this won’t cause your account to default. However, please be aware that

- It’ll take a much longer time to clear your debt

- The overall cost of your debt will be a lot higher

If you continue to make nine further minimum payments after receiving your persistent debt letter, you’ll get another reminder to pay more to your credit card balance.

If you continue to make a further nine minimum payments (eighteen in total) after receiving your first letter, then your card provider will look at ways to help you pay off your balance within three to four years. They could:

- Put you on an ‘increased payment plan’ to clear your card

- Look at other forms of credit which could help you pay the debt off

- Reduce your interest rate and suspend your card

Some credit card companies are changing their terms and conditions (T&C’s) to increase the minimum payment in order to get customers out of persistent debt.

If this happens to you, please be aware that if you don’t pay the increased amount each month you’ll then be in breach of your T&Cs. This could result in additional charges being applied to your balance and your card might even be suspended.

How can I get out of persistent debt?

By understanding your budget, you’ll know where you can cut back on spending. You can also start thinking about how much of the money you’ve saved can go towards getting out of persistent debt.

Visit the link below, and you’ll find a budgeting sheet that you can download, print and use to put your own budget together. You can download it as a PDF or Excel:

How can I make savings in my budget to pay my debt off quicker?

These articles can help you spot opportunities to reduce your outgoings:

- How to save money on your food shopping

- How to save money on Sky, Virgin and other TV packages

- How to save money on your mobile phone bill

- How to ‘declutter’ your finances

Can you commit to following some of these money-saving tips so you can repay more of your credit card, store card or catalogue bill?

Don’t forget to check the money-saving section of MoneyAware for more great ideas.

I can’t increase my repayments at the moment!

You may think that you’ll struggle to pay your other bills and debts when your credit card, catalogue or store card repayments increase. This is understandable: only being able to pay the minimum can be a sign that you’re struggling financially.

We provide free and confidential advice to thousands of people struggling to repay their credit cards, loans and other bills. We’ll look at your whole situation and give you information on how best to deal with your persistent debt, and any other debts you’ve got.