Our top 20 articles of 2017

We’ve had a grand old year on the MoneyAware blog, with 61...

Saving money is something that we can all get on board with. There are lots of ways to watch the pennies, it’s just a case of spotting them.

Moneymagpie’s Jasmine Birtles stopped by the blog to share some top tips on how the whole family can save a few pounds…

You may be thinking ‘everyone says how easy it is to save money, but putting it in practice is another thing altogether’. The good news is that you can save money the minute you get out of bed and start getting ready for the day. This is how a thrifty life is lived – baby steps, little by little, every day.

Once you know your own budget and needs, there’s a whole wealth of ways you can supercharge your savings. For now, let’s take a look at some thrifty tips that are so crafty you might just feel hoodwinked into saving money!

While it’s a great idea to have some canned goods on standby, it can be a bit of a false economy if you never actually use them.

While it’s a great idea to have some canned goods on standby, it can be a bit of a false economy if you never actually use them.

Before you go on ‘the big food shop’, take a quick look at the tins and jars in your cupboards before you buy more. Have a quick peek in the fridge and freezer while making a note of what’s in there – you might be able to whip up something out of just a few ingredients.

Try the BBC recipes section or Lovefoodhatewaste.com for some cheap and easy recipes. Vegetarian recipes are particularly good for using up all those tins and packets of beans and pulses that normally sit at the back of the cupboard.

Pinterest is packed with recipes that need only a few simple ingredients. There’s also Supercook, a widget that matches the stuff you’ve already got in to a tasty recipe!

You don’t have to become a vegetarian, but opting for a veggie dish twice a week might save money, as meat can be expensive. You can still get your daily amount of protein from eating eggs, lentils, beans, and nuts.

You don’t have to become a vegetarian, but opting for a veggie dish twice a week might save money, as meat can be expensive. You can still get your daily amount of protein from eating eggs, lentils, beans, and nuts.

Try mac’n’cheese, vegetarian lasagne, meatless chilli or a frittata. They’re all pretty filling and you’ll soon see the savings!

Laura from the MoneyAware team wrote a handy blogpost on vegetarian dishes that you can try.

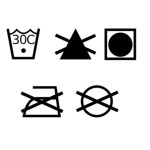

You don’t need to use two tablets, or as much powder as the box recommends, to get clean clothes (unless it’s caked in mud, paint and grass). It’s better to pre-soak clothes that have these ‘heavy’ stains, or use stain remover before the wash on marks like grease or felt tip.

You don’t need to use two tablets, or as much powder as the box recommends, to get clean clothes (unless it’s caked in mud, paint and grass). It’s better to pre-soak clothes that have these ‘heavy’ stains, or use stain remover before the wash on marks like grease or felt tip.

Did you know you can use baking soda to wash your clothes? If you’re low on detergent, combine what’s left with some baking soda and your clothes will wash up lovely and bright (and for more baking soda tips, check out Jenny’s blogpost).

Your own cards can be personalised for a special touch, and it also gives you a fun way to spend some creative time if you have children.

Your own cards can be personalised for a special touch, and it also gives you a fun way to spend some creative time if you have children.

The website Making Greeting Cards is loaded with design ideas for gorgeous, homemade cards. There are also hundreds of ideas on Pinterest if you just put ‘greetings cards ideas’ into the search bar. You can also find tips for recycling old Christmas cards, which can save money as well as the environment!

Check out the January sales for wrapping paper, gifts, cards and anything else you might need for next Christmas.

Check out the January sales for wrapping paper, gifts, cards and anything else you might need for next Christmas.

Shops are in a rush to get rid of seasonal stuff to make room, so it’ll often be less than half the price.

The same goes for pretty much any annual event like Easter, Valentine’s Day, Halloween and Guy Fawkes’ night.

You can furnish your whole house for a few hundred quid if you go second hand. Bicycles, furniture and appliances are on offer at greatly reduced prices on sites like eBay, Gumtree, Shpock and even Facebook Marketplace. A lot of the stuff is in great condition, and you can check photos online before you pick it up.

You can furnish your whole house for a few hundred quid if you go second hand. Bicycles, furniture and appliances are on offer at greatly reduced prices on sites like eBay, Gumtree, Shpock and even Facebook Marketplace. A lot of the stuff is in great condition, and you can check photos online before you pick it up.

While most people who flog their stuff through these website are trustworthy, it’s always a good idea to exercise a bit of caution. Scams tend to pop up a lot on Facebook, especially around the festive season. Jenny’s blogpost on how to avoid online scams can help you spot any dodgy dealers!

How many unused and unfinished hair, cosmetic and skin products are in your bathroom cupboards? Don’t leave the dregs to go crusty – use them up!

How many unused and unfinished hair, cosmetic and skin products are in your bathroom cupboards? Don’t leave the dregs to go crusty – use them up!

Make it a house policy to never buy any new shampoos, conditioners, make-up or lotions until you’ve used up the old ones. This could save you tens or even hundreds of pounds a year.

The best way to get to the last dregs of shampoo is to cut the bottle open (just be careful not to snip a finger in the process!). Once that’s done, you can:

Are you languishing in leftover bits of make-up? Check out Krazy Koupon Lady’s guide on how to make your war paint last longer.

Shop at charity shops in posh parts of town where you can buy fantastic designer finds at up to an 80% discount. Central London and affluent suburban areas are particularly good.

Shop at charity shops in posh parts of town where you can buy fantastic designer finds at up to an 80% discount. Central London and affluent suburban areas are particularly good.

Charity shops are also a great way to have a cut-price, glamorous wedding. Oxfam have special wedding shops (check out the excellent one in Aberdeen for example) with amazing wedding dresses worn only once…of course!

If you have fashion-savvy friends, or your wardrobe’s full of perfectly good clothes that you don’t want or don’t fit into anymore, then this is the tip for you.

If you have fashion-savvy friends, or your wardrobe’s full of perfectly good clothes that you don’t want or don’t fit into anymore, then this is the tip for you.

Have your friends and neighbours round for a ‘swishing’ party. This can be a great way to get new things for free and get rid of all the old items you no longer want.

Have a quick read of Pavan’s handy swishing blogpost to help you get started.

The re are so many deals out there to be had if you just work up the courage to ask. Even some high-street shops will respond if you ask.

re are so many deals out there to be had if you just work up the courage to ask. Even some high-street shops will respond if you ask.

Keep smiling while you do it as you could easily be knocked back at first. Do your research before by going to see what other retailers are charging and make sure you speak to someone in charge who has the authority to say yes.

If you’re feeling brave enough to barter, you need to read Mara’s guide to high street haggling over on Moneymagpie.com.

Furnishing your home can spiral out of control, cost-wise. The good news is there are hundreds of charity fundraising auctions and general auctions around which sell homeware and furniture at a good price.

Furnishing your home can spiral out of control, cost-wise. The good news is there are hundreds of charity fundraising auctions and general auctions around which sell homeware and furniture at a good price.

It’s also worth checking out police auctions as they have everything from jewellery to cars. Find out more on MoneySavingExpert.com, and get ready to bag some serious bargains!

If you have some old mobile phones languishing in a drawer, it’s time to make money from them.

If you have some old mobile phones languishing in a drawer, it’s time to make money from them.

Sites like Envirofone will pay to recycle most old mobile phones, and if yours is too old to have any value, at least they’ll recycle it responsibly.

As for your old CDs, DVDs and games, Ziffit will send you a cheque for what you send them or pay you directly via Paypal.

Changing to energy-saving bulbs will save money on your annual electricity bill, and up to £100 over the bulb’s lifetime.

Changing to energy-saving bulbs will save money on your annual electricity bill, and up to £100 over the bulb’s lifetime.

Energy-saving bulbs last up to 10 to 15 times as long, and use about a quarter to a fifth of the electricity that ordinary light bulbs use. Yes, they cost more to buy, but our the lifetime of the bulb the savings add up.

If you travel on the train more than a couple of times a year, it might be worth looking into getting a railcard. In some cases, the fee you pay for the railcard can be made back in a couple of trips or less.

If you travel on the train more than a couple of times a year, it might be worth looking into getting a railcard. In some cases, the fee you pay for the railcard can be made back in a couple of trips or less.

Railcards cost between £20-30 a year, and there’s a good chance you’ll be covered by at least one of them.

You could save 1/3 off rail journeys if:

Even if none of these railcards fit your circumstances, if you travel a lot in the Greater London Network Rail area you could still benefit. Find out more at Railcard.co.uk.

It’s amazing what’s around for free if you look hard enough. Try sites like Freecyle for free furniture, books, clothes, homeware, garden items and more that are being given away by people in your area.

It’s amazing what’s around for free if you look hard enough. Try sites like Freecyle for free furniture, books, clothes, homeware, garden items and more that are being given away by people in your area.

Also, take advantage of all free entertainment in your area. Use the library for free books, magazines and even talks. Check your local council’s website to see what they’re offering or do a quick search for ‘free events’ on Google.

The majority of broadband deals demand a landline although 95% of us would manage without one. However, if you live in central or north London you can get a standalone broadband service from Relish for just £20 a month.

The majority of broadband deals demand a landline although 95% of us would manage without one. However, if you live in central or north London you can get a standalone broadband service from Relish for just £20 a month.

And nowadays some internet providers have plans that give you broadband without the phone line.

The ‘Petrol Prices Pro’ app (on Android and Apple) costs £2.99 per year but is updated every weekday to give you the most up-to-date fuel prices from over 11,000 petrol stations across the UK. It’s also worth keeping an eye on your speed and driving as smoothly as possible as this cuts down petrol consumption.

The ‘Petrol Prices Pro’ app (on Android and Apple) costs £2.99 per year but is updated every weekday to give you the most up-to-date fuel prices from over 11,000 petrol stations across the UK. It’s also worth keeping an eye on your speed and driving as smoothly as possible as this cuts down petrol consumption.

While you’re at it, check out Peer’s blogpost on all the different ways you can save money with your car. James also took a look at how you can save money on the dreaded annual MOT.

According to Momondo.co.uk, you get the cheapest deals on flights if you book them at least 53 days in advance. They also found it’s cheapest to book on a Tuesday. Saturdays are the most expensive – on average 11.5 per cent dearer than buying on a Tuesday.

According to Momondo.co.uk, you get the cheapest deals on flights if you book them at least 53 days in advance. They also found it’s cheapest to book on a Tuesday. Saturdays are the most expensive – on average 11.5 per cent dearer than buying on a Tuesday.

If you’re planning to get away from it all, don’t miss James’s blogpost on how to have the perfect thrifty holiday.

Hungry for more money-saving ideas for the family? Make sure you download Jasmine’s FREE eBook “I’m not made of money! Budgeting tips for stressed parents (PDF)”. It’ll show you how to cut down on all your regular family costs, how to save when you’ve just had a baby, how to invest for your children, ways your family can make money together, and much more!

Jasmine Birtles is founder of MoneyMagpie.com which is full of money-making and money-saving ideas for everyone.