Debt Help and Advice Ltd ceases trading

Debt management firm Debt Help and Advice Limited ceased trading on 20...

Much like an illness, you can tell if you have a debt problem based on the symptoms that can arise. We call these symptoms ‘debt danger signs’.

Much like an illness, you can tell if you have a debt problem based on the symptoms that can arise. We call these symptoms ‘debt danger signs’.

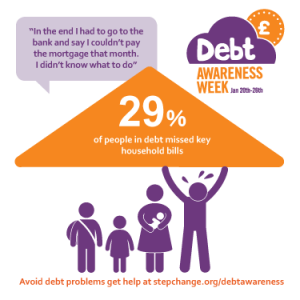

As part of our first national Debt Awareness Week we’re discussing the five danger signs to help you avoid them, or if you’ve tried to deal with your finances in this way, how to get help sooner.

One thing we come across time and time again is people with credit problems who prioritise the wrong type of bill.

The main bills you need to pay each month are household bills that keep a roof over your head, keep you warm, feed you and allow you to get to work. These are your priority debts – your rent, your mortgage, your utility bills such as your gas and electric.

Your council tax is also a priority bill and of course your water. These essential household bills are always to be paid before any personal credit debts.

Just because your credit card company might shout louder and be on the phone quicker than your utility provider or landlord doesn’t mean that you need to pay them first; in fact, in most cases it means the opposite.

These bills are for your essential living expenses. If you don’t pay your credit card your wellbeing may not be affected but if you don’t buy food you’ll put your health in danger. If you stop paying an unsecured personal loan you won’t be made homeless but if you stop paying your rent or mortgage you could be.

People often can’t see the difference between a priority and a non-priority and this can be dangerous. We often see people juggling essential household direct debits to make sure non-priority bills are paid first, that’s a real slippery slope.

We recently conducted a survey of our clients and we asked questions about how they got into debt and when they realised they needed help.

We were saddened to see an awful lot of clients that literally ran out of money to buy food because they over committed themselves on credit. Concerning too was the number of people with mortgage arrears, when they wrongly paid unsecured debts instead of secured debts like a mortgage.

“One of the overlooked bills had been taken out of our joint bank account. This left no money for food or petrol for the car. I had to ask my 82 year old mother for a few pounds to last us until my next payday”

“I was about to lose my house because I didn’t pay the mortgage”

“My mortgage lender phoned again and again, I was paying other bills such as the catalogues instead of the mortgage”

“We had to use our Children’s money to buy essentials”

“We couldn’t afford any food shopping after the credit bills were paid”

Going without food and jeopardising your living situation”

If you’re missing priority household bills to pay debts that are less of a priority you should try our Debt Awareness Week test to see how many of the five debt danger signs apply to you, how to avoid the others, and how we can help with free and impartial debt advice.

Client quotes obtained in debt danger signs survey, Dec 2013.